Oil and gas companies are increasingly focusing on near-field or infrastructure-led exploration (ILX) to reduce costs and risks in a challenging market environment.

ILX drilling has shown a significantly higher success rate compared to global exploration averages, making it a vital strategy for sustaining production and maximizing infrastructure use.

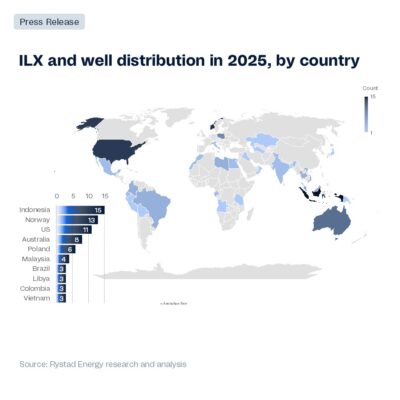

In 2025, Southeast Asia, Western Europe, and the deepwater US Gulf of Mexico are expected to be major ILX hotspots, with Southeast Asia leading in activity.Increasing financial constraints, a low commodity price environment and a shrinking pool of prospective basins have transformed how oil and gas players explore for new barrels. Across the globe operators are prioritizing low-risk, low-cost near field or infrastructure-led exploration (ILX) prospects instead of expensive, high-risk exploration plays. ILX, although not a recent phenomenon, is a reliable avenue that capitalizes on existing production hubs and pipeline networks to commercialize smaller discoveries that might otherwise remain untapped.

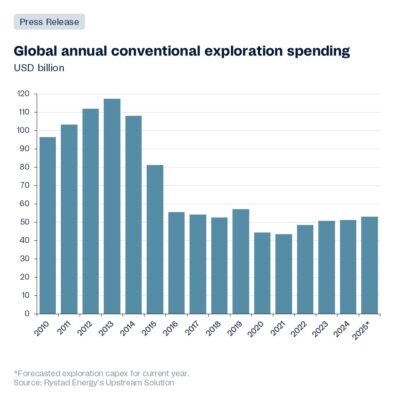

As price volatility, growing sustainability pressures and rigorous capital discipline take center stage, Rystad Energy predicts little growth of exploration budgets this year, standing at around $50 billion. According to the company’s analysis, Indonesia, the US and Norway will emerge as ILX hotspots this year.

The global industry downturn, paired with emissions regulations, high costs and scarce frontier exploration prospects, have created an unfavorable environment for greenfield exploration. The surge in ILX activity reflects a strategic push for cost-effective resource recovery, signaling a dynamic year ahead for near-field exploration.

Aatisha Mahajan, Vice President, Exploration Research, Rystad Energy

The global oil and gas industry is now confined to a handful of highly prospective basins, with explorers increasingly prioritizing low-cost, near-field prospects that can deliver quick returns. Conventional exploration spending has declined significantly, from its peak of over $117 billion annually in 2013 to around $50 billion per year in recent years. Unlike greenfield projects that require significant capital for standalone infrastructure, ILX benefits from lower development costs, shorter lead times, and reduced emissions. The strategy has so far proven to be a success, with the last five years boasting nearly 900 ILX wildcat wells drilled, achieving a 42% exploration success rate over this period, significantly exceeding the global exploration success rate of 32%.

With strong success rates and substantial resource additions, ILX drilling is vital for sustaining production and maximizing infrastructure use. As the industry adapts, ILX remains a key driver of upstream exploration, enhancing efficiency and unlocking new reserves.

Aatisha Mahajan, Vice President, Exploration Research, Rystad Energy

Of the 100 ILX wells planned for 2025, Southeast Asia is set to witness the highest activity, followed by Western Europe and North America. In Southeast Asia, ILX drilling is spread across four countries – Indonesia, Malaysia, Vietnam, and Thailand – spanning 15 distinct basins, highlighting the region’s diverse ILX opportunities. In Western Europe, ILX activity is concentrated entirely in Norway. Meanwhile, the deepwater region of the US Gulf of Mexico is expected to be a major ILX hotspot in 2025.

Source: crudeoil.com, Published: April 08, 2025